Hi guys,

Local trade anyone? I can send spanish and portuguese beers/ciders.

Cheers,

Alex.

Hi guys,

Local trade anyone? I can send spanish and portuguese beers/ciders.

Cheers,

Alex.

Hi Alex!

Would love to trade but we’re just going through the first steps of Brexit.

I’ve just managed to print the 3 pages of paperwork needed for a box to NL.

I will see how that goes first…

Well I’d love to if you’re not bored as we’ve had some trades already.

I am definitely up for trade with you.

If you’re sending a gift do you need all the paperwork? As long as you don’t declare it as beer?

Hi Simon.

I would love to trade with you again but I agree…let´s see how this mess of Brexit affects delivery cost and customs paperwork.

Cheers!

@Cuso @Koelschtrinker Let´s do it!

2 out of the 3 cheaper parcel services have dropped the option to send packages from Germany to UK. The third one doubled prices. Not really an option anymore.

I would be also interested of doing an EU locals trade, but once it gets warmer. Just the other week I lost 3 antidoot bottles because of the cold, so don’t want to risk at the moment

It’s unbelievable.

There’s the address label & then 3 customs labels & a further shipping summary. You have to list every item & find the relevant 10 digit customs tariff code from Gov website. The paperwork has to be in a plastic wallet or envelope on the package, so it can be opened & mustn’t be just stuck to the box.

For example I sent some salt & vinegar crisps you can’t just list snacks, you’ve got to find the exact code which in the case of crisps is:

“Thin slices, fried or baked, whether or not salted or flavoured, in airtight packings, suitable for immediate consumption - Tariff Code: 20 05 20 20”

I obviously also sent beer -

“Beer made from malt in under 10 litre containers - Tariff Code: 22 03 00 01”

You can list the parcel as “Gift” & each receiving country gas own tax & duty free limits. I’m sending to NL so the gift has to valued under €22.

Only a few couriers allow beer. Prior to Brexit, I’ve always used IPostParcels, who were bought by DHL but they’ve put the price up since Brexit from £11 to £28.

I’ve used Parcel force this time. They allow beer & it’s cost me £13, collected to NL.

It’s being collected tomorrow.

I can let you know how I get on this thread if you like?

I would come back to this in a few month, when I have reduced my cellar a bit - if you like another trade to Germany around Easter ![]()

Just fyi, this 22€ limit will go away around July (unless the regulation is pushed back again), so EU receiver must pay VAT even if it is really small sum. And before anyone gets wrong ideas: this is not aimed towards UK, but to tax cheap Chinese web order stuff.

That’s interesting, so in NL you won’t be able to receive a gift, Christmas present for example, without paying tax?

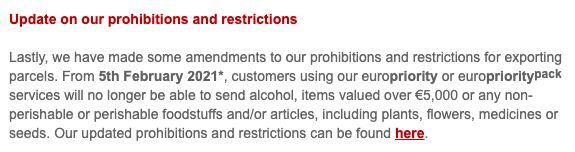

Sorry to be the bearer of bad news but as of Feb 5th Parcelforce do not allow alcohol to be sent. The only exception is two items per package, sent economy, and even then they cannot guarantee the recipient country will accept it.

I have an account with Parcelforce and send beer through my webshop. All parcels still in the system will be returned. I had one successfully make it to France early Jan, one to France returned the start of this week. Both had correct paperwork.

Apparently Parcelforce’s partners in Europe GLS and Fedex will not accept Alcohol anymore. You can’t just label it as something else as every parcel is being opened, literally every one I’ve sent has been opened twice, once in the UK and in Europe.

The cost per parcel came to £67. Entirely up to you, but expect big problems, expense and a returned parcel.

Looks like only DHL then at £27.

I actually don’t understand the issue.

Not 100% sure about private person to private person, you can read the EU explanation here: https://ec.europa.eu/taxation_customs/business/vat/modernising-vat-cross-border-ecommerce_en

Unless you can insure the package, I would just mark it as a gift and cheapest still believable price as value.

Interested to see what happens. Although mainly because I was planning to visit relatives in Finland this summer and post myself some beers. But we’ve put that off for another year.

I had a beer parcel from my friend Nick, Isle of Harris brewery, it had two bottles of beer in it and some black pudding, interestingly these were not opened or checked at all, he listed the value as 10GBP and gift it was just a sticker on the side of the box. But on the flipside (if you’ll pardon the pun) a record that I actually purchased last year, pre-order and was released in January which I paid about 38GBP for, and which was clearly a record, had all of the paperwork, cost etc on the front, tax details everything, anyway this was opened and then when delivered DHL would not let me have this without paying a further €14.06, which was really frustrating.

I think we should handle this like we do with shipping to/from the US. There alcohol-shipping is prohibited with every company, but no one cares. Just declare a low value (1€/bottle or so) and declare it as softdrinks / collectible glassware etc… The UK just ships it to f.ex. Germany - and here the custom officers don’t care whats inside - they just look at the value declared. And if you have to pic it up at a customs-office (which I had with US parcels several times) the officers just complain that the beer was not declared correctly… but you can explain why and (here in Germany) you can just take it with you as the taxes don’t differ from soft-drinks…

I had this one time as well. You can complain at the tax-office that gets the money DHL collects. Just take pictures and explain why the taxes are incorrect - and then you’ll get the money back. It worked at least one time for me… but as they’re officers who work quite correct, it should work this way. Good luck!!